AAVA Climate Performance Tokens

Combining the power of blockchain with the opportunities in a thriving climate business sector

In a nutshell

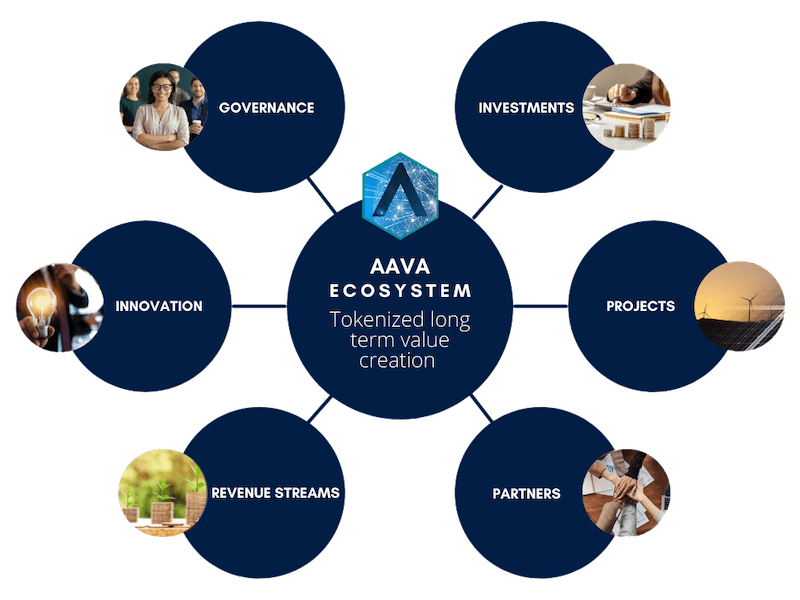

The AAVA Climate Performance ecosystem leverages blockchain and the DAO framework to implement a robust, secure and accessible pathway for Token holders to take part in high performing climate markets.

Disruptive Innovation

Token holders tap into market leading expertise and access to a business with several lines of operation targeting short-, medium- and long-term prosperity.

Shared decision making through the AAVA DAO, a Digital Autonomous Organization where the Members participate in management.

AAVA ecosystem key tools:

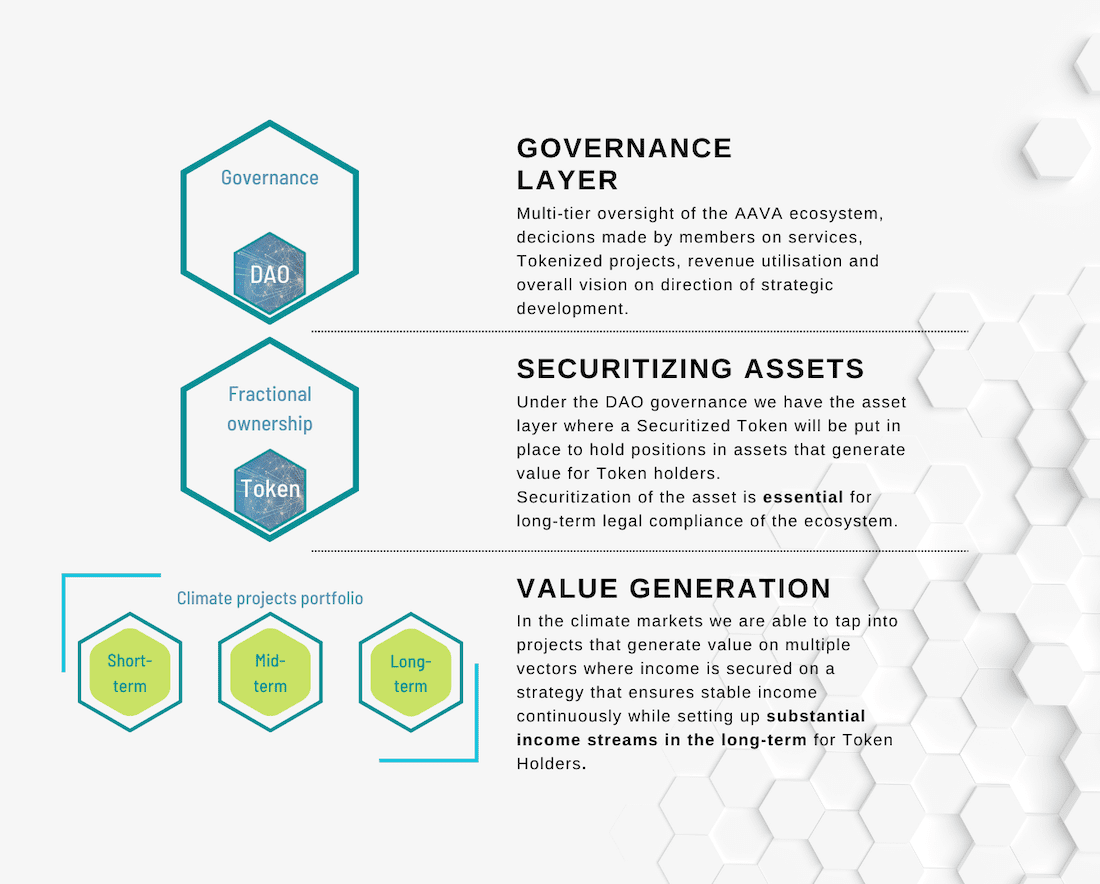

Decision making through a Distributed Autonomous Organisation (AAVA DAO) where Members manage and control the AAVA Climate Performance Tokens, and the ecosystem development activities.

Securing assets behind a robust AAVA Token that will be set up to access climate projects and distribute profits to Token Holders.

The platform offers extensive advantages for both DAO Members and Token holders over traditional structures.

This allows us to leverage an ecosystem to develop a range of projects to combat climate change and create short-, mid-, and long-term revenue streams and value for stakeholders.

Time for Action

With more than a decade of climate market expertise, we know the players, and more importantly, we know the opportunities that are open for scaling up with new partners. Key to implementation needs deep understanding of markets and which areas are most likelly to gain traction, to find the right activities while minimising risks.

The time to move is now, the industry is maturing rapidly and primary players in the sector are already expanding through continuous acquisitions. Market consolidation naturally provides interesting prospects to participants with a stake, but also means that the best opportunities are also being scooped up.

Taking climate business on chain

Coming from the climate markets, we look at project development with a long perspective. Projects can last from 10 years to 30 years in some cases, this is why we take longetivity of an operating structure seriously.

The way we see tokenised structures, we are now in a phase of regulatory uncertainty. Rather than venturing to the gray area we should prepare for compliance and do things properly. This will convert to competitive advantage when conversations start being about oversight, KYC/AML, security, and fiduciary duties.

Our vision of a DAO implementation is focused on starting off with utility and governance token where the DAO is the controlling entity that represents the Token with a vested equity.

Why climate markets?

The climate markets and demand for environmental assets are booming.

The inventory of carbon credits over the last year has dropped dramatically.

Capital is actively seeking project development opportunities, but these are highly complex and time consuming developments creating a strong barrier for access.

New entrants are struggling to capitalize in the climate market opportunity as access is very limited and primarily managed by market actors that are already flooded with prospective partners. Having said that, with the right experience, network and tools, opportunities can be accessed.

The sector is ripe for innovation and scaling up . Through the fusing of web3 digital tools with climate related business development can provide participants access to considerable success on multiple vectors.

By Tokenizing project access, we are opening up fractional participation, while providing extensive benefits, such as control and liquidity to a market that traditionally was not able to offer this.

"Getting to net zero carbon emissions by 2050 is going to require a revolution in the production of everything we produce, and a revolution in everything we consume. The process of creating fuel, food and construction materials, with all the needs that we have as humanity, it all has to be reinvented,"

The next 1,000 unicorns — startups with a valuation over $1 billion — will be from a sector "that help the world decarbonize and make the energy transition affordable for all consumers.”

Blackrock CEO Larry Fink

External link: Business Insider

"The world is beginning to grasp that to meet our objective of 1.5 degrees and keep it alive, we need to reduce emissions by 50% over the balance of this decade," Carney said. "This will require unprecedented investment and that in turn depends on clear country commitments, ambitious country policies, and a transformation of the financial sector.”

Carney, who heads the Taskforce on Scaling Voluntary Carbon Markets (TSVCM), told a crowd at Climate Week NYC in September that there is a real prospect to scale the VCM by 100-fold by the middle of this decade.

Mark Carney, Integrity Council for the Voluntary Carbon Market

External link: Clean Energy News - IHS Markit

A report from McKinsey in April 2022 sheds light on the potential value pools that could surpass USD 12 Trillion in annual revenue by 2030. This macroeconomic shift may create the largest reallocation of capital in history.

The Net Zero growth opportunity is driving business to realign, differentiate, tap into new markets, and ultimately increase their value.

McKinsey Quarterly

Recommended reading at:

McKinsey Quarterly - April 2022McKinsey Quarterlyplaying-offense-to-create-value-in-the-net-zero-transition

Token Ecosystem Roadmap

October 2021

European based Ventures company commits to climate market business development

November 2021

Conceptualization for Climate Markets opportunity is launched

February 2021

Evaluation and mapping of blockchain based solutions introduced

March 2022

First workshop on DAO with Superdao

April 2022

First DAO drafts created, implementation work begins

May 2022

AAVA DAO draft version is launched, AAVA Token website draft version is launched

June 2022

Website public release, DAO airdrops and functionality and governance mechanics testing

September 2022

Launch partner mapping, climate market business model refinement.

Q4 2022

Set up of legal and implementation partnerships.

Q1 2023

Private sales of AAVA DAO Memberships begin

Q2 Regulatory set up

Q3-4

Private sale of AAVA Tokens begins and locking in of first climate performance projects.

Built with industry leaders

Contact us to secure a position today

We are in a pre-sale phase for DAO Memberships. While we have not began broad marketing efforts the infrastructure is live for active memberships, we are now open for expressions of interest and reservations.

Contact us to secure your position today.